|

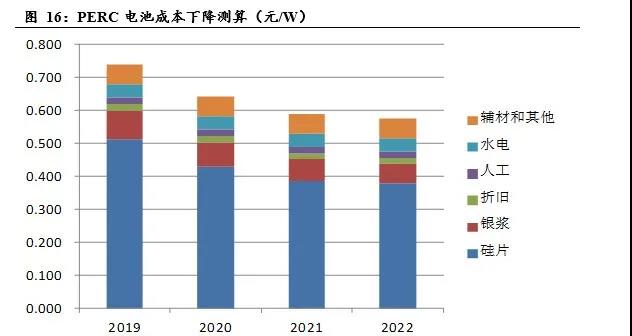

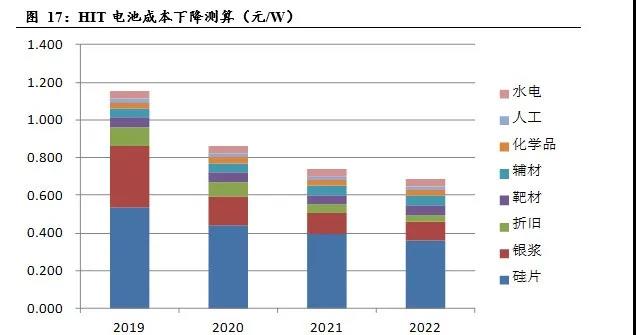

HIT can reduce costs faster than PERC, and it will be cost-effective for investment from 2021. This article divides and assumes the various costs of HIT and PERC batteries, and calculates their respective cost reduction paths.

Cost reduction path comparison

Wafer: Assume that PERC will gradually decrease from 180 μm to 160 μm in 2022, and HIT will gradually decrease from 160 μm to 130 μm. The reduction in silicon consumption cost will result in the elimination of the P-type wafer premium from N-type silicon wafers, and the high wattage per chip Diluted, so that HIT's silicon wafer cost in 2019 is 0.02 yuan per W disadvantage compared to PERC, and it will become 0.02 yuan per W cost advantage in 2022.

Silver paste: Assuming that HIT silver paste consumption is 300mg / piece in 2019, the multi-gate technology will gradually mature in 2020, and silver paste will be reduced to 150mg / piece, and thereafter it will decrease by 10% year by year. PERC silver paste assumes a total consumption of 120mg / tablet of silver in 2019, after which it will decrease by 10% every year. The price of PERC positive silver remained at 4,200 yuan / kg, and the HIT silver paste gradually decreased from 6,000 yuan / kg to 5,000 yuan / kg.

Depreciation: PERC equipment investment will decrease by 10% year-on-year on the basis of 200 million yuan / GW in 2019. HIT equipment investment will be 1 billion yuan / GW in 2019 and 700 million yuan / GW in 2020. After that, domestic production will be reduced to 400-500 million yuan. Yuan / GW.

When to tie

From our estimated cost decline trend, the cost of HIT batteries is expected to gradually decrease from 1.15 yuan / W in 2019 to 0.69 yuan / W in 2022, and the cost difference with PERC will decrease from 0.41 yuan / W in 2019 to 0.11 yuan in 2022. / W.

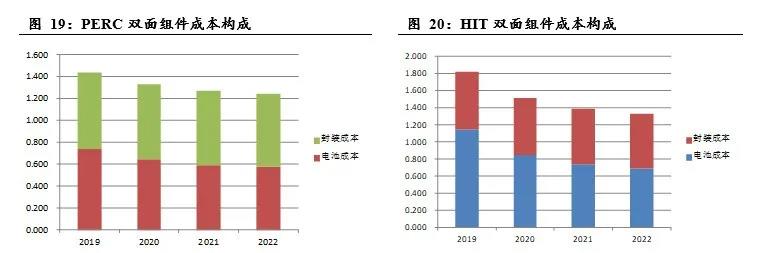

In the component link, because the heterojunction conversion efficiency is higher, it has a dilutive effect on the component packaging cost. Heterojunction conversion efficiency improves faster than PERC, so the effect of thinning on the package will continue to improve. From our measured cost downward trend, the cost of HIT components is expected to gradually decrease from 1.83 yuan / W in 2019 to 1.33 yuan / W in 2022. The cost difference with PERC will decrease from 0.39 yuan / W in 2019 to 0.08 yuan in 2022 / W.

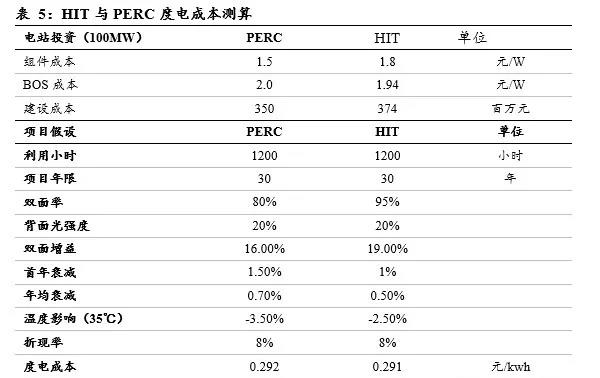

Similar to the process in which PERC enjoys a premium and replaces conventional products, an important source of high-efficiency component premium is the cost savings of BOS. The current HIT production line efficiency is about 1 percentage point higher than that of PERC. Assuming that the HIT conversion efficiency is 25% in 2022, PERC conversion The efficiency is 23.5%. Based on the area-related BOS cost of 1.3 yuan / W, a 1.5 percentage point lead in HIT efficiency can bring BOS cost savings of 0.08 yuan / W. According to our calculation of the module cost, the price difference between the two modules is 0.08 yuan / W in 2022. After considering the cost savings of BOS, the two will be able to agree on the initial cost of the overall photovoltaic installation in 2022.

From the perspective of the terminal power station, demonstrating that HIT and PERC can be the same in installed cost in 2022, which only shows that HIT is feasible in the application of terminal power stations. For the power plant owner, it is not the cost of the battery and components that is in production, but the final cost of electricity after using a certain type of component. For battery manufacturers, companies that have pioneered new technologies in the early stage may pay more attention to the guidance of the industry's development direction and the establishment of their own status and long-term structure. However, for mainstream manufacturers in the industry or new entrants outside the industry, they are more concerned about The profitability of the product and the investment return period, the investment return rate will be attractive, and will turn to a new direction on a large scale. Therefore, we calculated the cost of electricity and product prices for HIT and PERC power stations.

Under our assumptions, when the price of the HIT module is 0.3 yuan / W higher than the price of the PERC module, the cost of electricity will be the same. When the price of the HIT module is 1.8 yuan / W and the overall installed cost is 3.74 yuan / W, the power cost of the HIT is 0.291 yuan / kwh.

The price of 1.5 yuan / W for PERC modules is close to the current market price. It is expected that the current HIT module with investment value for terminal power stations should be around 1.8 yuan / W.

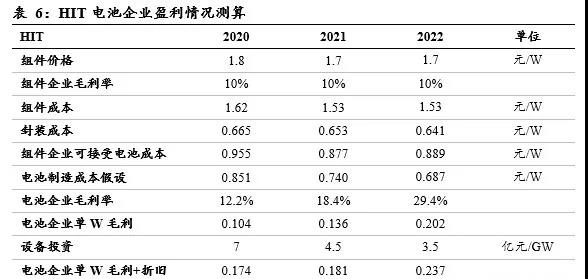

The subsequent price reduction of PERC is relatively small. We statically assume that the price of PERC components will be reduced to 1.4 yuan / W in 2021-2022, and the corresponding price of HIT components in the large-scale market is 1.7 yuan / W. According to our cost assumptions Profitability of HIT battery companies. As the heterojunction has certain compatibility in the component link, and the fixed investment cost of the component is relatively low, we assume that the pure component link can obtain 10% slightly higher than the industry's average gross profit level.

According to our price and cost calculations, the profitability of HIT batteries can be increased year by year. In 2021, the battery gross margin is 18.4%, and the gross profit per single W + depreciation is 0.18 yuan. Assuming that the three fees are 0.06 yuan / W, the corresponding cash inflow per W is about 0.12 yuan. Under the assumption of 450 million yuan / GW of equipment investment, The investment return period of the equipment is about 4 years. If you consider the construction of 150 million yuan / GW of plant and infrastructure, the investment return period is about 5 years. In 2022, the gross profit margin of the battery chip is 29.4%, and the gross profit of single W + depreciation is 0.237 yuan. Assuming that the three fees are at 0.06 yuan / W, the corresponding cash inflow per W is about 0.177 yuan. Under the assumption of 350 million yuan / GW of equipment investment The investment return period is about 2 years. If you consider the construction of 150 million yuan / GW of plant and infrastructure, the investment return period is about 3 years. Therefore, according to our calculations, it is already economical to engage in HIT battery investment in 2021, and the investment return period in 2022 is already very attractive. It is expected that battery companies will have large-scale production.

|